Свежие публикации

Бренд регулярно проводит распродажи. Они бывают связаны со сменой сезонов, предпраздничными датами,...

Технологии поиска и подбора персонала не стоят на месте. Методы, отлично работавшие еще несколько лет назад,...

Последнее обновление Март 2019

Нарушение норм ТК и дискриминация в сфере трудового права сейчас, к...

Сегодня не всех людей устраивает работа по найму - небольшой заработок, который невозможно самостоятельно...

По такому случаю можно купить и ощипать утку даже в условиях городской квартиры. А если ваш муж, не дай бог,...

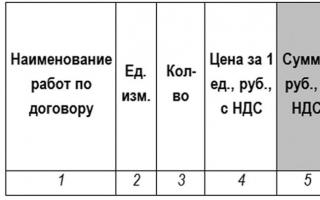

Накопительные ведомости надо вести. В не зависимости от величины объекта создайте таблицы в екселе и ведите...

Обучение в университете предполагает то, что сразу после его окончания вы свободно найдете себе рабочее...

Сегодня мы с вами поговорим о том, что представляет собой профессия юрист

. В списке современности юристы...

Когда компании пытаются применить методы бережливого производства в офисах, или в сфере услуг, очень многие...

Вам понадобится КомпьютерДоступ к сети интернетПакет программ Microsoft OfficeПринтер, копировальный...

БиографияСостояниеПартнерыКонкурентыСфера интересовЛичная жизнь

Биография

В 1973г. окончил Тюменский...

Басманный суд Москвы по ходатайству Следственного комитета России в четверг, 8 мая, арестовал тринадцатого...

Михаил Маратович Фридман

(родился 21 апреля 1964 во Львове) - крупный российский предприниматель....

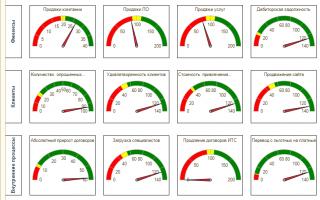

Большой функциональный ряд пакета «1С:Предприятие 8. Управление по целям и KPI» позволяет анализировать...

129594, Москва, 5-й проезд Марьиной рощи, 15а "Марьина Роща" (495) 631-66-65, +7 (495)...