Recent publications

Last update March 2019 Violation of Labor Code norms and discrimination in the field of labor law is now...

You will need a Computer, Internet access, Microsoft Office software, Printer, copier...

BiographyConditionPartnersCompetitorsField of interestsPersonal life Biography In 1973 graduated from Tyumen...

The Basmanny Court of Moscow, at the request of the Investigative Committee of Russia, on Thursday, May 8, arrested the thirteenth...

The seminar will help expand knowledge and develop coaching skills. During the training the features will be revealed...

The intrigue around Transaero continues to develop. November 5, after National Unity Day, for one share...

The regulation on a department (service) of an enterprise (organization) is a document regulating the activities...

Send your good work in the knowledge base is simple. Use the form below Students...

Calculation of production costs in production is determined for various purposes, one of which is...

Average daily earnings is an amount expressed in monetary terms and corresponding to the daily...

Job description of an electrician for repairing electrical machines I. GENERAL PROVISIONS 1.1. Electrician...

Effective management of store personnel is the key to enterprise growth. Find out what professional skills...

Nadezhda Nikolaeva A Tale of Wintering and Migratory Birds A Tale of Wintering and Migratory Birds Doctor...

Now we will tell you how to make worms from gelatin. Your kids will definitely appreciate this delicacy. And also...

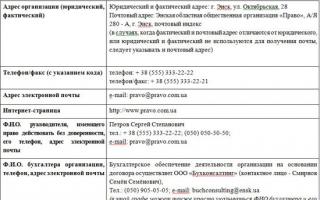

When choosing an LLC as a form of doing business, an entrepreneur thinks about what attributes are...